Catch up on the latest news and resources

Posted by on March 17, 2020

At Jolt Credit Union, your wellness and financial well-being are our top priority as we face the rapidly evolving coronavirus (COVID-19) pandemic. Here are five additional ways to help you stay healthy and avoid spreading germs.

Posted by on January 31, 2020

It’s time to decide where to watch the BIG game. While going to a sports bar has appeal, more people are choosing to stay home. In cities with NFL teams, as well as in cities without NFL teams, it’s been reported that Sunday sports bar foot traffic dropped by double digits.

Posted by on January 22, 2020

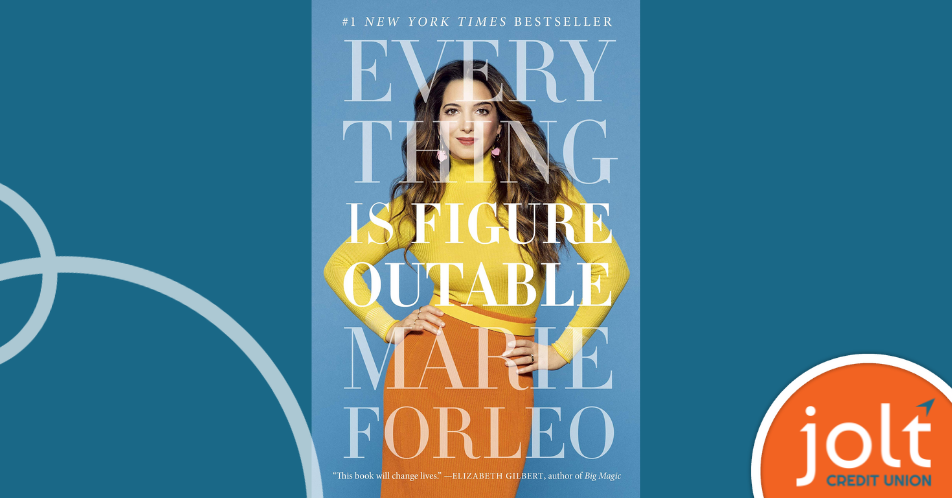

Dreaming up big goals is easy; it’s finding a way to achieve them that can sometimes feel impossible. Maybe you decided this is the year you double your contributions to your retirement account or finally pull yourself out of debt. Whatever your big dreams may be, Marie Forleo’s new book Everything is Figureoutable will show you how to make them happen.

Forleo describes her mom as a woman with the tenacity of a bulldog and the language of a truck driver. The author’s chief philosophy, and the primary principle of her book, is centered on the wise words her mom shared with her, “Nothing in life is that complicated. You can do whatever you set your mind to if you just roll up your sleeves, get in there, and do it. Everything is figureoutable.”

Posted by on January 17, 2020

Planning ahead and cooking at home can save you a lot of money. Here are 11 ways to cut down your grocery bill.

Posted by GreenPath Financial Wellness on January 10, 2020

The dawn of a new decade is a time for powerful new beginnings. Are you ready for a powerful New Year’s resolution?

Eliminating debt, learning new spending habits, or building savings are choices that can change your life. They can affect your entire well-being– from stress levels, to physical and mental health. The new year and new decade is a great time to commit to your financial health.

Posted by on November 12, 2019

Here at Jolt Credit Union, we hate to see your money go to waste, so we've put together a list of misleading advertising schemes you may come across when hunting for deals this Black Friday.

Be an informed consumer and shop smartly!

Posted by on November 8, 2019

Thanksgiving prep stressing you out? Wondering how you're going to get everything done in time for the big day and stick to your budget at the same time?

We're here to help! Whether you're travelling home for the holiday or hosting a houseful of guests, we've got you covered. Jolt Credit Union is proud to present clever Thanksgiving hacks to save you time, stress and money as you prepare for Turkey Day.

Posted by GreenPath Financial Wellness on October 24, 2019

October is Financial Planning Month, and with the New Year right around the corner, now is a great time to make sure you are on track to meet your short- and long-term financial goals.

Here are three tips to keep your spending in check and finish the year out strong:

Posted by Melissa Pashak, Marketing Specialist on October 21, 2019

Don’t blow big bucks on your Halloween décor when you can DIY for a fraction of the price! Check out our list of creative, fun and inexpensive projects to make your home the spookiest haunt on the block.